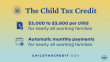

In mid-July, families started receiving their advance Child Tax Credit payments as part of the American Rescue Plan signed into law by President Biden. You can help them.

Most eligible families will automatically receive monthly payments of $250 or $300 per child through December. Individuals can claim the other half next year when they file their 2021 income tax return.

If families didn’t make enough to be required to file taxes in 2020 or 2019, they can still get benefits by signing up using the IRS non-filer portal. They can also find out whether they are eligible and enrolled to receive their payment using the IRS online tool. The tool also allows individuals to provide or update bank account information or unenroll from advance payments.

If your group or organization would like to help hard-to-reach families access their advance payments, check out Code for America's Navigator resources.

With all of us working together, we can help families get the relief they deserve.